Spiritual Investing #4/7: Why We Make Bad Money Decisions

In audio #4/7, we'll do some myth-busting and go deep into the most important emotional catalysts that cause us to make terrible investment decisions, as well as simple steps you can take to avoid and overcome them.

Transcript

Today we've got a really important topic.

If you want to make more money,

Be a spiritual investor,

Be really prosperous.

And it's this.

I want to show you why your current and past approach to investing probably doesn't work very well and then offer you a new approach that does.

And this is important because you may be thinking,

Oh Brent,

Just tell me what to do.

It's not that simple.

That's part of the problem.

The entire approach has to change,

Not just the action you're taking.

And most people aren't willing to give up their old way of doing things until they're convinced it doesn't work and they know something better.

So I'm going to do both here.

I'm going to explain why how you've been investing probably is never going to work and from there show you that something does.

So one of the big reasons why most people don't make a lot of money with their investments,

Why they can't become that spiritual investor doing what you love day to day and managing your investments for highly leveraged income that will support you so you can take the pressure off your day job,

Is that we think it's all about manipulative action.

We tend to,

And this is a myth,

Right?

I want to bust this myth right now.

The amount of money you make from investing is not just about manipulative action.

In other words,

It's not just about picking the right stock or the right crypto or being on the right exchange or having the right app.

That's what a lot of people want you to believe because they have something to sell you that you think will get you closer,

Right?

No.

There's all sorts of newsletters out there that will say,

Hey,

Buy this stock or that stock.

I'm not saying that's a bad thing.

If you need information and it's a trustworthy newsletter that's reputable,

That's been around for a while,

That isn't highly biased,

Go for it,

Right?

I've had a lot of success with good newsletters.

But don't think the information alone is going to make you rich.

It won't.

Most people think,

Oh,

Brent,

You know,

I don't want to worry about the inside or any of that.

Just tell me what to buy,

Right?

Tell me what stock,

Tell me what crypto,

Tell me what foreign exchange,

What real estate,

Whatever your thing is,

Right?

Just tell me what to buy and I'll get rich.

No,

That's what I'm saying.

It's not that simple.

It's not as simple as just find the right manipulative action.

Really the way I see it,

There's really three really important parts to the result of an investment.

And we have to get clear on all of them.

The first part is the action.

It is necessary to take action,

Right?

You need to do research.

You may want to look at charts.

You might want to talk to your financial advisor or your lawyer,

Your accountant,

Your brother-in-law who works at an investment bank,

Whoever.

Absolutely.

Please do those things.

Read the newsletters,

Watch the news,

Stay informed,

Right?

But understand that the manipulative action is just one leg on the stool.

A stool cannot stand on one leg.

No.

You build a one-legged stool,

It falls every time,

Right?

And this is a big reason why so many of us don't do well with investing.

All we see is one leg of the stool and we try to manipulate the heck out of it,

Right?

Give me more information,

Give me better advice,

Right?

Tell me what to buy.

It's not that simple.

At the same time,

There has to be action,

Right?

You do need to do research,

Read the newsletters,

Talk to your brother-in-law,

Whatever your thing is,

Right?

You have to go out and take action and buy things and invest in them to give the universe something to work with.

You got to put yourself in play,

Right?

It does not work to just sit around and meditate and watch the secret and expect money to fall out of the sky.

I mean,

Maybe you get lucky,

Right?

But you could also buy a lottery ticket and maybe get lucky,

Sure.

A lot of people think,

Oh,

I can just watch The Secret seven times and sit around in my underwear and smoke weed and play Xbox and I'm magically going to get rich.

No.

You got to do something,

Right?

So the action is one leg of the stool,

But not the only one.

The biggest mistake people make is they think it's the only one.

It's not.

The mistake some people in the new age world make is they think action is not important.

It is.

But it's really just to put yourself in play,

To give the universe something to work with.

Because after all,

If you never make an investment,

How in the world are you going to be successful,

Right?

It's like the pizza delivery metaphor we talked about with the thermostat.

There needs to be a delivery guy,

Right?

He's an important part of the process,

But he's not the only part.

And manipulating the heck out of the pizza delivery guy does not get you dinner consistently,

Right?

But you do need it.

So that's the action,

Right?

But just know it's much more to it than just action.

The second piece is the circumstance,

The context.

And this is so critical because many people are making investment decisions based on the past,

Not the present and the future.

So as an example,

A lot of investment newsletters do this.

They'll show you a graph that goes,

Oh,

If you had invested this much money on this day in our fund,

You would have made 870% in three weeks versus 2% on the S&P 500,

Right?

Well,

Just know it's a bunch of nonsense.

I'm not saying the facts are incorrect,

But they cherry picked it.

They literally have software that runs millions of combinations of what to buy and when and when to sell it to cherry pick the absolute best possible result.

And then your brain looks at it and goes,

Oh my gosh,

I want to make 70,

180% on my investment in the next three weeks.

Bye bye bye.

Right?

And you get killed.

Why?

That's an artificially cherry picked set of data points.

And even if it was legit,

That context is gone,

Right?

I could tell you,

Hey,

If you bought Bitcoin in 2010,

You could have bought it for like,

You know,

10 cents a coin,

Right?

And if you had bought a dollar worth of Bitcoin,

It would now be worth a quarter million dollars.

That may be true,

But that doesn't help you because why it's not 2010 anymore.

So a lot of the investment products and advisors will try to trick you into assuming that the future is like the past.

That's what I want you to hear.

The future is not always like the past,

But our brains,

Our human brains are very fallible to that.

Why?

For the rational mind,

All it has to work with is the past.

The data,

The information,

The context,

What happened,

That's all we have to work with in terms of the rational mind.

The good news is your intuitive mind is not limited to the past.

Your intuitive mind can see what's going to be happening in the future and lead you to the right investment.

And that's a higher level skill and I can absolutely help you with that.

But just know,

Please don't think that doing something that worked well a year ago or five years ago or 10 years ago is going to work well now.

Why?

It's a different context,

Right?

It's a different market.

I've seen this with internet marketing.

I've spent an outrageous amount of money on internet marketing consultants and programs and software and templates and all these things,

Right?

And they have all these great recommendations and glowing testimonials.

Oh,

You know,

I bought this system and my coaching business went from 10 grand a month to a hundred grand a month.

And I'm like,

Yeah,

Yeah,

Let me buy that,

Right?

I go spend a bunch of money and it doesn't work.

Why?

It's not that it never worked.

It's just that system works three years ago,

Right?

It doesn't work today.

There's a huge bias in the human brain to expect that the future will be like the past.

Just know that it will not,

At least not consistently,

Right?

So be careful with that.

Look at the past,

But take it as a data point that describes the past.

What happens today and tomorrow and next week may be something totally different.

If you just keep that in mind,

That can make a huge difference in the success of your investing.

The third piece I want to talk about,

Which in a lot of ways is the most significant,

The most important is the consciousness or energy of the investor.

That is probably the most important thing,

More important than action,

More important than context.

What do I mean by that?

It's your internal programming.

It's your subconscious beliefs.

It's how you behave.

That's how you see things.

It's how you think about things.

That is your biggest advantage over time.

Why?

Context change,

Right?

Actions change,

But consciousness is always helpful.

We look at someone like Elon Musk or Bill Gates.

They had great consciousness for money.

I have no doubt that if Bill Gates would have been born 30 years later,

He still would have made a ton of money.

Why?

It's not about the one opportunity to build operating systems for IBM PCs in 1980 or whatever,

Right?

That's one he took advantage of and became incredibly wealthy and successful.

But that was his consciousness that made him successful,

Not just the action,

Not just the circumstance,

Right?

It's really all about consciousness.

This is the subconscious financial thermostat,

People,

Right?

You're going to make about the same amount of money,

No matter what you do for your job or what you invest in.

Why?

It's all about you at the end of the day.

It's not only about the action.

You need to take the action,

Right?

It's not only about the context.

There's always a context.

But the part you can control is the you,

Your beliefs,

Your subconscious programs,

How you behave,

How you think about things,

How you relate to problems.

That is the most important thing.

There's plenty of examples of people who have very similar incomes and budgets,

Who make similar investments at a similar time and a similar context and get totally different results.

Why?

They have different energy.

They have different consciousness.

I've seen that with traders.

One of the things I've seen consistently is I've had a lot of clients who were traders,

Maybe not thousands,

Certainly at least a hundred.

And the story I hear is always the same.

They go,

Hey,

Brent,

I spent a whole lot of time,

A whole lot of money learning this system,

Right?

And every trader thinks their system is the best and everyone else is stupid for not using it,

Right?

Nothing personal.

It's just,

This is what I've seen,

Right?

And they're convinced their system works because their teacher or whoever they bought it from convinced them of that.

Okay,

I'm not saying you're wrong,

Right?

I'm just saying that's what happens.

And they go and they spend all this time,

All this money,

All this energy practicing their system in what's called paper trading,

Right?

You're not actually buying and selling stocks or Forex or whatever.

You're just running a computer simulation to build your skill.

And they'll tell me,

Brent,

I kill it with paper trading,

Right?

But the instant I start putting real money in,

I get killed.

Why?

It's consciousness,

Right?

That's emotional investing.

Because when it's real money on the line that affects your life,

We get into emotion and the attachment to a result wipes us out.

And they go back to paper trading and they start making money again,

Killing everything,

Right?

Making tons of money.

Then they go back to real trading with real money and they get wiped out.

It's that attachment to result.

Let me give an example from the sports world.

Let's take,

For example,

A free throw in basketball.

And even if you don't know anything about sports,

You've probably seen a basketball game,

Right?

If you're fouled,

You get free throws.

Here's the thing about free throws.

You are 15 feet from the basket and the basket is 10 feet high and you have 30 seconds to shoot.

The defense,

The other team,

Cannot get in your way.

They can't block it.

They can't do anything but sit and wait for you to shoot.

And this is important because a free throw in basketball is exactly the same shot,

Whether you're on the school playground or practicing in the gym or in overtime in the NBA finals.

Why?

Again,

15 feet from the basket,

10 foot basket,

You got 30 seconds to shoot,

Right?

The other team cannot get in your way,

Block you,

Whatever,

Right?

They just got to wait.

Here's what's so interesting.

In the NBA,

Professional basketball,

The average free throw percentage from games is about 70 some percent.

But if you watch those same guys shoot in practice,

They almost never miss.

It feels like they make every free throw.

That in practice,

Most NBA players shoot 90% plus.

And that's crazy.

What's the difference,

Right?

It's the same shot,

Right?

It's the same distance.

The basket's at the same height.

It's the same ball.

Everything is the same and no defense allowed,

Right?

The difference is all in the head,

Psychological.

In a real game,

It matters.

You might win the game or lose the game.

You might get cut from the team.

You might get a huge bonus.

You might get a $100 million contract.

So there's enormous pressure because there's attachment.

So the guy that shoots 90% in practice shoots 60% in the game.

This is true of pretty much all NBA players throughout history.

Stock market trading is the same.

Crypto is the same.

Dating is the same.

Being a parent,

It's all the same.

When we get attached to the result,

When we think it really matters,

Our performance suffers.

That's consciousness.

That's mindset.

That's energy.

Another great example to make this point is what's called mirror trading.

That there are people out there that trade currencies and stock options and futures and crypto and all these things,

Right?

Anything you can trade,

There are people that offer mirror services.

What does that mean?

It means if you pay some guy a thousand dollars a month,

You can literally watch his computer and see exactly what he's buying and how much and when and at what price.

And the point is you just want to mirror his trades,

Right?

That whatever he's buying,

You just do the same.

And you would think,

Well,

Brent,

If I'm watching this guy who's really good at trading and I'm trying to do the exact same trades at the same time and the same amount,

Shouldn't I get the same results?

The answer is no,

You won't.

It's crazy,

Right?

You think if you're doing the same things,

You should get the same result.

You don't.

What's the difference?

The context is the same.

The action is the same,

But the consciousness and energy is different.

That's why I say the consciousness and energy is the most important piece.

It is your internal beliefs,

Your internally configured myths,

Your relationship to your life and your story and what happens.

That's the most important thing.

That's our investor psychology right there.

And there's great tools that you can use to master this.

The awakening process almost mandatory because when you understand the truth of you and your life and how things really work,

Letting go of attachment is much easier.

It really is.

I could not do it pre- too much head,

Too much thinking,

Too much manipulative ego.

And so the awakening critical for getting past your attachment to performing in higher levels in stressful situations.

The other is the thermostat we talked about earlier in the series.

Just know that no matter what you invest in or when,

Over five years,

You're going to end up with the same amount of money.

It really does not matter.

And I also want to encourage everyone,

Develop your intuitive mind.

I'm going to give you some tips on that.

I really want to get this information out there.

I want to empower the world to do what they love day-to-day and make plenty of money on investments.

That's why I'm putting this series out there,

Right?

If you haven't done so yet,

Go through the spiritual power quiz.

I'll help you identify your secret spiritual power and show you how to use it to make more money through smart investing.

I do a lot of live events.

Sign up for one of my heal-a-thons or one of my coaching calls.

Would love to work with you,

Let you experience this for yourself.

So back to what we were talking about before in terms of how do we make better investors,

Right?

How do we get this perfect psychology?

How do we get past attachment?

How do we learn how to clear our subconscious to make good decisions?

Well,

Just realize that pretty much your whole life,

You've relied on your ego,

Your rational mind to guide you through everything.

And I don't mean that as a criticism.

You probably have no awareness of any other way to live,

Right?

Very few people do.

I didn't until I was really in my 40s.

Kind of sad.

I thought I was so smart.

But no matter how smart you think you are,

Your rational mind is limited.

What it's going to be doing is running around trying to manipulate the right action to get the result.

That's why I said that's one leg on the stool,

Right?

You don't want to be manipulating the means of delivery.

Go to the source.

One of the things I'll talk about in a lot of my materials and trainings is that your life works just like your computer or your phone.

You have a bunch of programs that run,

Right?

And these programs are the code in your subconscious.

So you have a program in your subconscious mind for how much money you make,

For your physical health,

For your mental health,

For how happy you are,

For how many friends you have.

It's all coded inside of you.

And so there was a blonde joke that circulated back in the 90s that went something like this.

How do you know when a computer?

Well,

It's easy.

Your monitor is covered with black marker and whiteout.

So kind of funny,

Right?

Apologies to the blondes.

It's not personal.

Why is that funny?

Well,

We know that if your software isn't working,

Drawing on the monitor doesn't help,

Does it?

No.

You have to keep drawing on the monitor,

Right?

You need to fix the code.

You have to get to the source,

The code inside the hard drive,

The memory,

Right?

Your life is the same.

Which investments you pick,

What stocks you buy,

How much,

When,

Leverage,

All that.

That's all drawing on the monitor.

You might need to do it,

Right?

But it's not going to change the source code.

You got to get into what's inside of you,

The subconscious mind.

Clean up that,

Raise your subconscious thermostat,

Clear your blocks,

Get reconnected to the quantum field.

And then investment will be much easier.

Because if you have strong consciousness,

A high thermostat setting,

You can invest in almost anything and make lots of money.

It really is the most important part,

But most people don't even know it's there,

Right?

And have no awareness of,

Even if they know about it,

What to do about it.

This is why I'm here doing this series.

I want to show you the truth of what's really going on behind the scenes with your consciousness,

Your energy,

And your money,

And show you how to make changes that will bring real benefits to your life.

Until then,

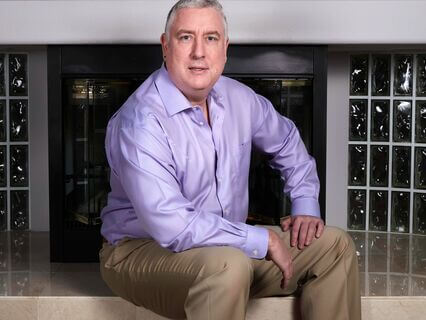

I'm Brett Michael Phillips,

Signing up for now.

Goodbye,

Good night,

Good afternoon,

Depending on where you are,

Good morning,

Maybe.

Take care and namaste.

5.0 (3)

Recent Reviews

Hope

March 28, 2025

Thanks for another interesting talk Brent! I'll check your website for the missing talks in this series and your other offerings. Love and blessings to you